Financial inclusion trends in 2024

Abdul Hannan Farooq

Share this blog

3 Financial Inclusion Trends In 2024

Financial inclusion has been topical especially in recent years and still presently is. With the way the world has been evolving, financial inclusion becomes an imperative. Financial inclusion refers to individuals’ and businesses’ ability to easily access essential & cost-effective mainstream financial products & services. Key to note is that ideally, financial inclusion should be indiscriminate, especially along income lines. Financial inclusion is also known as inclusive finance. It is vital that we get to be abreast with financial inclusion trends from time to time. In this discussion we shall be unpacking some of those trends for financial inclusion in 2024.

Increase In AI-Driven Solutions Targeting The Financially Excluded

The role of AI in the finance industry is birthing more and more solutions that are driving financial inclusion upwards. Artificial intelligence is enabling the net to be cast wider to reach especially the underserved people in society. More so, AI is making it easier to come up withfinancial solutions tailored for the specific underserved group(s) in question. AI is also enabling more comprehensive customer experiences. Another important role artificial intelligence is playing in finance is protecting against, detecting & curtailing fraud.

The financially excluded tend to be the easiest targets due to their lack of knowledge or experience. AI is now playing a big role is cushioning freshly financially included groups from manipulation & deception. Artificial intelligence is also increasingly being used in efforts to equip the financially excluded with financial literacy. These are some of the examples demonstrating the rising trend of AI-driven solutions towards increased financial inclusion.

A Continued Surge In Mobile & Digital Money & Banking Services

This is a trend that has been steadily taking root especially in developing countries. We are continuing to see this trend spur on and will continue to moving forward. Mobile & digital solutions are making it much easier to increase financial inclusion in developing countries. Solutions that are being deployed appeal toboth those using the internet and to those offline. The latter entails the use of USSD codes which do not need internet connections or an internet-enabled smartphone. This essentially means even the most marginalized communities e.g. low income earners are becoming financially included.

With that framework it is making almost entire populations to have fingertip access to basic financial services. Advancements in internet connectivity e.g. rolling out of 5G networks are also catalysing this surge more. Overall the digital & mobility element are eliminating the need for one to visit physical banking halls. In fact, it is enabling financial institutions to deploy their services without having to build or rent physical buildings to entertain customers. That means it has become cheaper for them to reach the underserved who often time dwell in remote locations.

Financial Literacy Initiatives Becoming More Main Stream

The thrust to teach or acquaint people with financial education is rising. Again, the digital and mobility aspect is making this easier and more widespread. In some cases, people are becoming more financially literate through material they receive as SMSes on their phones. Another interesting approach is gamifying financial literacy initiatives. This is making the learning experience more fun and interactive. Financial literacy has often been the preserve of adults but that is now changing.

There is now a steady rise in financial literacy education being offered in main stream school systems. There is even a steady rise in financial literacy literature specifically meant for kids. It is particularly in this space where gamification is being employed a lot. The end result is that financial inclusion is now being championed from very tender ages, just as much asamongst adults. Both the private & public sectors are rallying behind financial literacy initiatives. The great thing is the initiatives are often free & accessible for all.

Small Business-Oriented Financial Inclusion Being Championed More

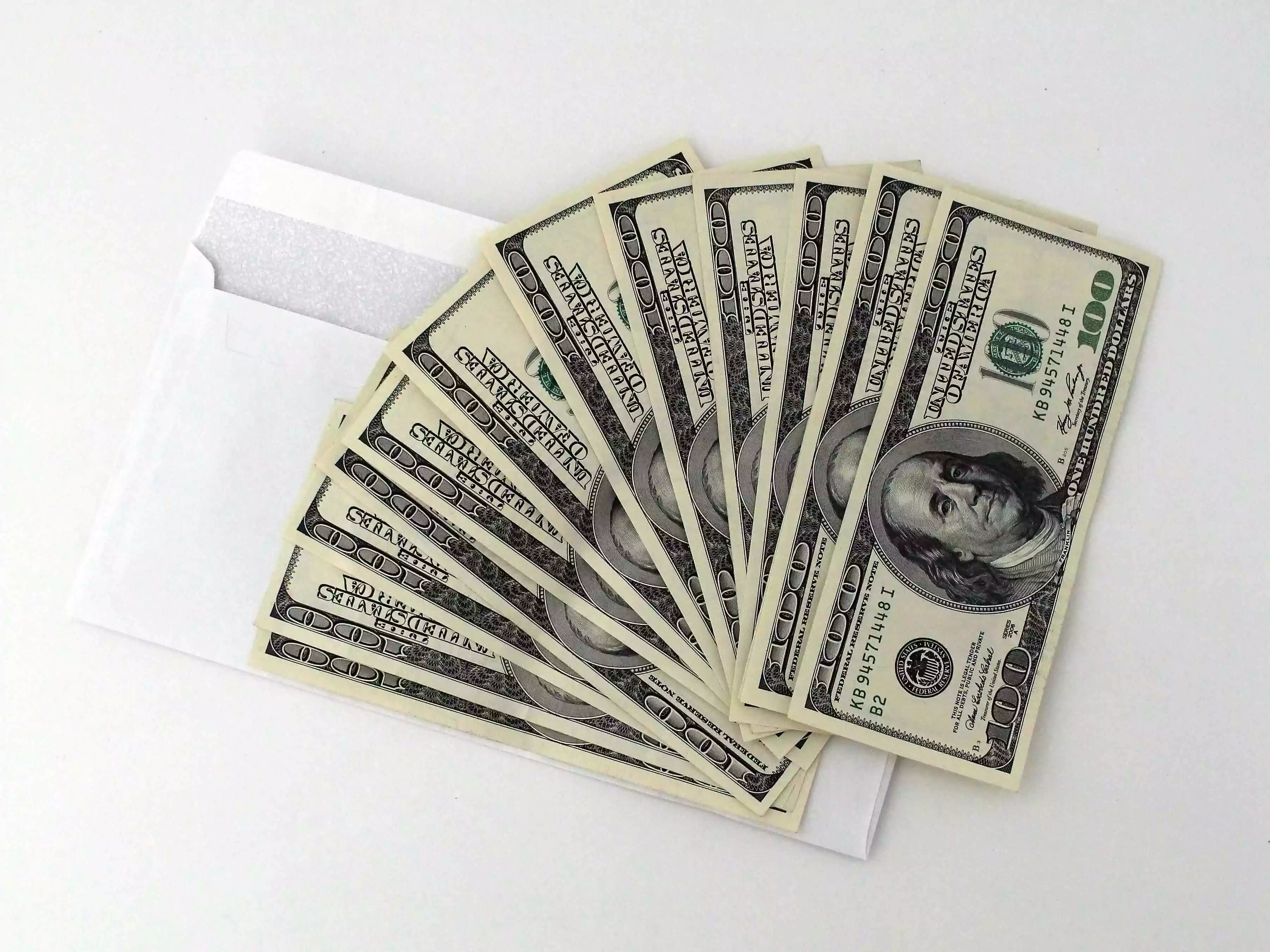

So there has been a growing realization that small businesses are at the core of economic development in any nation. Efforts are increasingly being made to enable easier, cheaper, and main stream access to credit & basic business-centred financial products and services. For the most part, small businesses have often been neglected. No wonder they have typically bemoaned lack of financial & institutional support. The trend now though is that both the public & private sectors are paying more attention to small businesses. Actually many of the fintech solutions being developed and deployed now are aimed at small businesses.

The digital economy continues to grow. More and more businesses and startups are entering that space. In fact, you cannot really be competitive if you are not participating in it. This creates a dynamic where players seek to reach more and more people with their products & services. This means they have to enable easy access and easy ways for people to pay for or purchase them. Essentially the financially excluded become prospects of interest and players actively seek to convert them. This mix of dynamics is collectively leading to increased financial inclusion as enterprises endeavour to cash in more. Thus it is refreshing to see that financial inclusion is on an upward & forward trajectory.