Emergency Fund: Why You Need One And How To Build It

Tapiwa Gondo

Share this blog

Personal finances are pivotal in leading a fulfilling life. Forbes once cited a survey done in 2023 which indicated that almost 80 percent of people in the US live pay check to pay check. This means 8 in every 10 Americans are constantly grappling with making ends meet. More than 50 percent of Americans will hit rock bottom if they were suddenly to lose their monthly income(s). These dynamics also hold true in most parts of the world & it is even steeper in some places. Personal financial management is a compulsory subject matter everyone should learn. One of the elements of personal financial management is setting up an emergency fund. Let us discuss that in detail.

Importance Of Having An Emergency Fund

Living from pay check to pay check is not prudent. Life is always riddled with many moving parts. There will be times when things do not go according to plan. There will be times when unexpected or unforeseen incidents occur. If you are not prepared for such times you will usually be forced to get into debt. The possibilities of what would entail an emergency are infinite. It could be a medical condition, it could economic shifts; it could be political shifts. It could even be the sudden loss of a job. Emergencies can be anything but the typical element is that they usually require money. That is why it is imperative for you to have an emergency fund. As much as money may be tight, it is in your best interest to pursue ways to build an emergency fund.

How Much You Should Put In An Emergency Fund

This is a common question people have regarding an emergency fund. It is a good question because putting little into your emergency fund may be as good as nothing. You need to build an emergency fund that can fully or substantially address any emergency that comes your way. You need to know the minimum amount you should have in your emergency fund. Then you need to also understand how you arrive at those figures.

As in, there are guiding principles you must adhere to. So, perspectives and opinions differ on this but how much you put into your emergency fund should not be afixed figure per se. Rather it should be a multiple of your monthly expenses. This means the ultimate figure will vary from individual to individual.

Here is the thing, consider what your living expenses are for one month. You can use an average if you want; it depends on your context. Then project several months forward. That is to say, your emergency fund should be several months’ worth of your living expenses. How many months you may wonder? Well, the recommended minimum is between 3 and 6 months’ worth of living expenses. Thus you can go as high as you want depending on your earning power. So the minimum should be 3 months’ worth but more is always better.

The difference between 3 months minimum and 6 months minimum is usually one’s living situation. A single person with no dependants can do well with 3 months minimum. A single parent (or married) but with a single income would do well do to aim for 6 months minimum. The important thing is to consider your set of circumstances.

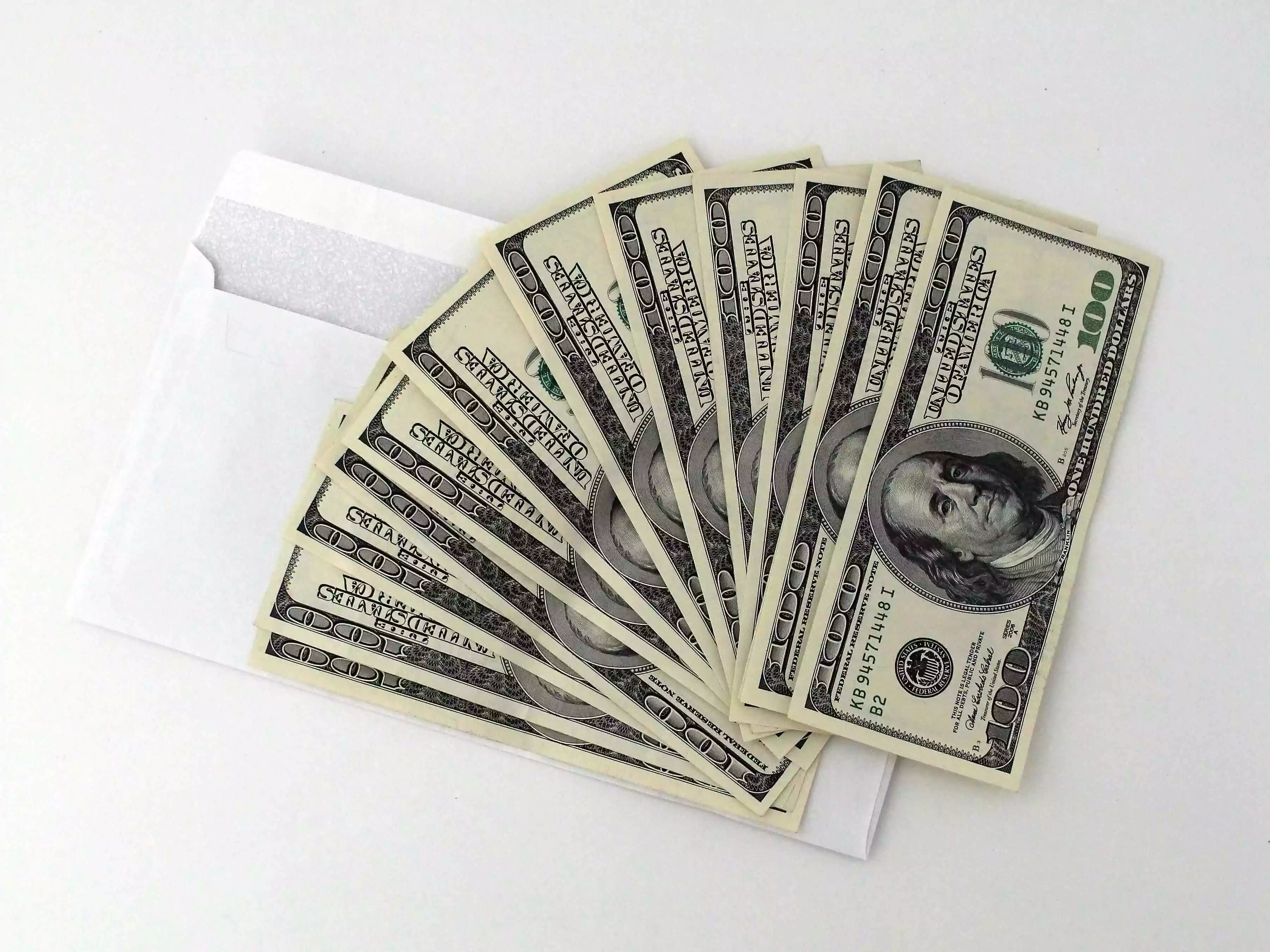

Where You Should Keep Your Emergency Fund

Having or building an emergency fund is great and all. However, keeping it in the wrong place can defeat the purpose. There are two things at play here namely, the security of the money and maintaining (or increasing) its value. What you ultimately settle for will cater to those two dynamics. The most basic thing many people do is to simply keep the money safe somewhere. It could be at home, in safe somewhere, or such like. For those who do not want much hassle, this can actually work. What is important is to ensure the money is secure. However, that approach may not be inflation-proof. That is why it may be best to consider keeping your emergency fund in a manner that makes it accrue value.

If you are to put it in a bank account it should not be a checking account. Go for account types that offer competitive interest rates and entail easy access in the event you urgently need to withdraw the money. This is often considered the best approach. Other options are there e.g. money markets which tend to offer great interest rates and liquidity. However, in all of this you have to weigh the associated risks. That is why there is no single universal answer. As highlighted earlier, there are many who keep their emergency funds in secure safe somewhere and it works for them.

People with tight budgets are often the ones who need emergency funds the most. They are same people who often give excuses for not being able to set aside anything. The trick though is to start small and beconsistent. You must also consider cutting some unnecessary expenditure; there always is. For instance, eating out can be cut off. Occasionally you may get monetary gifts or gifts you can convert to cash. Direct all that to your emergency fund. You may even have things you own that you rarely or never use that you can sell. There could be times you get an unexpected windfall, do not splurge it recklessly. All this is to show you that if determined, you can end up with a good emergency fund. No matter the situation.